- Previous

- Share

Rent Freeze & Caps Could Be More Of A Burden Than A Solution

The nobility of caring for our fellow residents and wanting to help alleviate the housing and rental stress currently being experienced by many households across Australia should be applauded. However, we need to make the right policy choices and select the appropriate approach to achieve a more affordable housing environment. The suggested rental freeze or caps might provide immediate relief from rent rate increases, but they could have counterproductive effects in the medium to longer-term.

In formulating robust housing policy, we need to focus on the medium and longer-term, not the short-term. History has shown that short-term policies exacerbate market volatility, as we have witnessed with first home buyers grants and more recently residential building stimuli.

Why might the suggested rent freeze and caps end up being counterproductive?

Firstly, the sharp increase in interest rates over the past year has put more financial burden on investors with mortgages. Based on well-known and regular advice given by many residential property investment advisors – ‘leverage is your friend’ – many would be mortgaged to the hilt! Freezing or capping rents would also freeze and cap their rental income. If investors cannot meet their investment loan repayments with their rental income, they will be forced to tap into savings or other income streams, leading to higher mortgage stress potential loan defaults. This, in turn, could prompt investors to divest or dump, resulting in lower rental stock and generate additional pressure for rent increases.

Even if legislation enforces rent freezes or caps, renters themselves will more than likely ignore the legislation and offer the landlord higher rent just to secure shelter for them and/or their family in a highly competitive rental market. It might immediately help some existing tenants, but it does nothing for new tenants.

Secondly, the cost to build residential dwellings and houses prices have also remained relatively high, compounded by higher mortgage repayments due to increased interest rates. This means that investors need higher rental income to justify initiating a new build or purchasing investments off the plan. In an environment where further interest rate hikes are likely no investor, in their right mind, will allocate capital to such projects or investments knowing that potential income streams are frozen or capped. This is particularly relevant in the build-to-rent sector.

Thirdly, rent freeze and caps may lead more landlords to only sign short-term leases and or be unwilling to renew leases, as they would be able to sign new leases more regularly at higher rents if supply remains constrained. This would mean renters may be forced to move more regularly basis, which can be quite costly and increase housing insecurity.

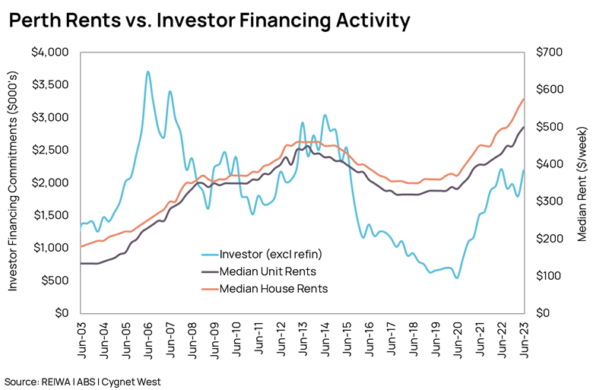

A fourth impact may be reduced volume, quality, or appropriateness of new rental supply. Frozen and capped rents will obviously mean constrained income, this constrained income will lead to developers delivering more cheaply built, potentially lower quality and small, dwellings to the market to make investments financially viable. Freezing or capping rents, while having less impact on existing investors, will make it difficult for new investments. As the chart below with data from the Australian Bureau of Statistics and the Real Estate Institute of Western Australia shows, there is a natural and direct correlation between rental increases and investor financing activity. Any attempt to interfere with this natural economic relationship will likely deliver negative outcomes unless there are other accompanying policies to boost rental supply.

The is no point in freezing or capping rents if it reduces rental stock availability, reduce the quality of supply, or dampen new rental supply overall. The growing population will mean renters face lower housing options even if they could afford to pay higher rents. More could end up on public housing waiting lists, living in cars, couch surfing or even on the streets.

There are also the unintended consequences that would likely arise from a taxation perspective that must also be considered. If investors are unable to meet investment loan repayments with rental income due to rent freezes and caps, it may trigger increased negative gearing tax claims. This could reduce overall federal taxation collections, potentially limiting government funds to distribute to the very people we are looking to help and put more pressure on government debt.

The main proponents of the freeze and cap policy, such as the Greens Party, already have major concerns about negative gearing being a burden on the tax system. Therefore, it is perplexing that they would want to introduce measures to exacerbate the problem.

Furthermore, rental freezes and caps may stifle dwelling price growth, which could negatively impact federal capital gains taxation, stamp duty, and even land taxation at state and local government levels. When rental growth is frozen, so too will be the gross rental values (GRVs) of dwellings, which are typically used to calculate council rates and land tax.

To address the affordability crisis, the focus should be on reforms that increase appropriate dwelling supply.

It is the lack of supply that underlies the problem, and increasing supply will ultimately alleviate the situation. Some may find this economic concept odd – the cure for high prices is even higher prices. In free markets, it has proven to be true throughout history. Higher prices tend to generate increased profits, and increased profits incentivise dwelling investments and, consequently, more supply.

Larger incomes and profits also lead to higher taxation revenue, providing more government funds to redistribute to those in need, allocate to public infrastructure and services, and pay down government debt. When supply rises to sufficient levels, market rents and prices would naturally readjust as it has in past cycles.