- Previous

- Share

Investor exodus fueling Perth rental shortage.

More than 16,000 homes have been removed from Perth’s rental stock since 2021, with investors exiting the market emerging as a major contributor to the increasing pressure being experienced by prospective tenants.

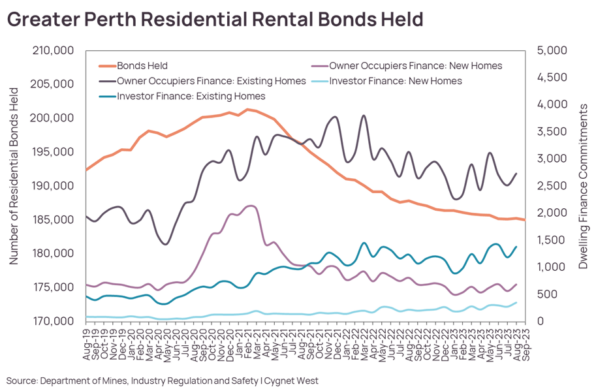

Analysis by leading independent property agency Cygnet West shows the total number of bonds held for residential properties are down 8.1 per cent, or 16,324, since a cyclical peak was reached in early 2021.

Financing activity for owner occupiers is currently considerably higher than at the beginning of the pandemic, with around 3,641 dwelling finance commitments recorded in August 2023.

Investor finance levels have been improving, with around 1,870 investor loans approved in August, but these two buyer groups are mostly competing for established dwelling stock due to the low volume of new supply and delays or long construction lead times experienced in the past three years.

Population growth also continues to be strong, with the number of people living in WA increasing to 2.86 million in the March quarter in 2023, after a record year of growth. More than 78,000 new residents came to WA in the quarter, 52,664 of which was the result of overseas migration.

Data from the Real Estate Institute of Western Australia shows Perth’s rental vacancy rate dropped back to 0.8 per cent in August, with the median rent for houses reaching a record of $585 per week, and $530 per week for units in September.

Cygnet West Head of Research Quyen Quach said the data indicated the number of owner-occupiers buying existing rental properties from investors was having a big impact on the rental market. Owner occupiers have been shunning the new build market and have increasingly competed with investors for existing stock, and in a lot of instances it appears they are winning and absorbing what use to be rental stock.

“If we look at the three important variables that determine residential market performance – population growth, financing activity and dwelling completions – the finance data appears to show that the shortage of rental supply has been driven by owner-occupiers buying properties from investors who are selling,” Mr Quach said.

“This has resulted in a fall in the number of rental properties available for lease, a drop in the vacancy rate and persistent low rental listing volumes as Perth’s population continues to expand.”

Mr Quach said high housing construction costs, long build times and builder solvency risks had led to many prospective buyers shunning new builds since the end of the COVID-19 HomeBuilder stimuli in 2021 and opting for established dwellings.

“This has also been a factor in the persistently low numbers of houses listed for sale.

“Anything coming onto the market that is appropriately priced is being snapped up almost immediately.

“This is why we are seeing transaction volumes for established homes rivalling that of the astonishing period of 2005-2006, when annual median price growth in Perth hit circa 40 per cent and Perth’s median exceeded that of Greater Sydney.”

The biggest concern from this cycle, Mr Quach said, is that dwelling completions have been significantly lower than the previous boom, but population growth is currently much higher than that recorded in 2006.

“At the same time, listings for sale have reached the equivalent of 2006,” he said.

“This has meant that the supply demand imbalance is potentially greater than that seen in the 2006 period.

“To some extent, buyers have been lucky the RBA forced interest rates back to 2006 levels.

“Had this not occurred and rates remained at historical lows, house price growth could have exploded like they did in 2006, potentially making buying much more difficult, especially for first home buyers.

“Any subsequent correction, as would inevitably occur after such booms, would be more severe and damaging.”

Mr Quach said the slow delivery of new housing in the last three years had also contributed to the shortage of rental supply, but the market was showing signs of turning.

“Dwelling completions have started increased off the back of record volumes under construction, potentially providing modest relief for renters going forward,” he said.

“However, increasingly prohibitive rental rates are still driving many to share housing and short-term accommodation.

“Increasing the number of people in households is something we need to continue in the short to medium-term to allow supply to catch up with demand.”