- Previous

- Share

Record Dwellings Under Construction

Building Stimulus and Capacity Constraints Underpin Record Dwelling Under Construction Pipeline

Housing supply has historically been in-elastic due to the labour, materials and time involved in delivering a completed dwelling. Recently data released by the ABS relating to residential dwelling construction supports the supply side constraints widely discussed over the past year.

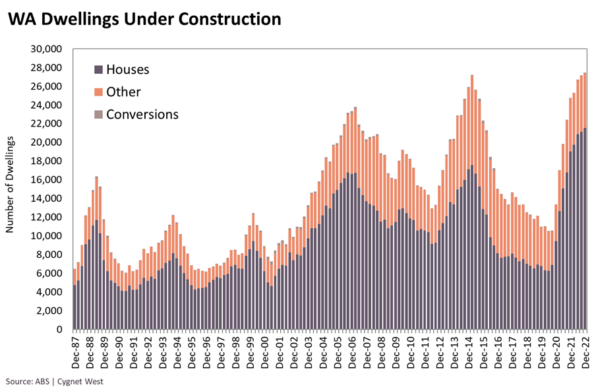

The chart below represents the supply cycles Western Australia has experienced in the past 35 years, and these cycles have tended to coincide with strong economic growth, which is expected, as strong economic activity boosts employment opportunities and subsequently population growth and housing demand.

Prior to the outbreak of COVID-19, Western Australia’s economy was already a good year into a recovery phase from the post resources boom downturn. Dwelling demand was starting to increase, and dwelling prices were also recovering. However, in response to the economic threats posed by the onset of the COVID-19 pandemic, both federal and state governments implemented two sets of residential building stimuli, this led to a surge in residential land demand, building approvals, and eventually record high ‘Houses’ dwelling commencements.

The record level of activity created a dilemma, in Western Australia and across the country. The pandemic did impact economic growth, but the success of keeping COVID-19 outbreaks suppressed, especially in Western Australia, during this time allowed the economy to quickly recovery, aided by economic stimuli in other areas of the economy.

That economic rebound drove strong demand for goods and services. Looking around the state, there is a large volume of investment activity taking place, in both the private and public sector. All of which have placed upward pressure on demand for labour and materials. As material and labour supply chains were disrupted during the pandemic, dwelling construction progress slowed and significantly extended dwelling delivery timeframes. This was compounded by a tight skilled labour market with 457 Visa workers having left the State and no immigration to top up rising demand for skilled and unskilled labour.

Further to this, during the Covid-19 lockdown, many West Australian travellers, off-shore workers and Expats returned to the State, absorbing a significant proportion of the limited accommodation availability in the Perth Market.

Some of these pre-Covid-19 ‘offshore’ West Australians and others have started to travel again and leave the state for opportunities overseas, which may help free up some rental accommodation for new arrivals.

All-the-while, post Covid-19 lockdown, has seen the state’s population growth accelerate, with population change Sep-21 to Sep-22 of some 50,000 persons.

Covid-19 also contributed to changes in accommodation and living preferences that overall has led to a decline in household sizes, which in itself amplified housing demand.

The external supply chain disruptions and logistic costs have moderated to pre Covid-19 levels which should flow to improving construction supply chains and a moderation of construction inflation. This however does not deal with the builder capacity constraint issue, which will only improve with construction completions and additional labour resources. These capacity limitations have seen significant increases to construction timeframes for traditional dwellings and multi-residential accommodation.

The strong immigration is flowing through to an improving labour skilled market but as noted above, it is also contributing to strong accommodation demand at a point of limited stock availability.

We now have a situation where the cumulative impact of the extended building timeframes has led to a record high volume of ‘Houses’ still under construction. According to ABS statistics, during the December 2022 quarter there was a total of 21,524 ‘Houses’ and 5,871 ‘Other’ dwelling types under construction in Western Australia. The volume of ‘Houses’ under construction is 22.5% higher than the previous 2014 record high of 17,572 dwellings.

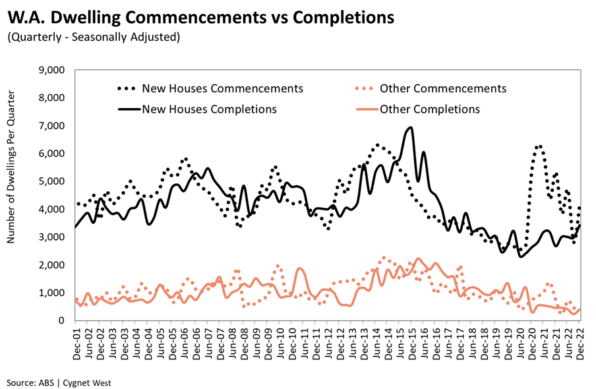

However, despite record volumes under construction, completions have only increased gradually in the past year, as the chart below shows. This weak supply in a period of strong demand has generally held Perth accommodation prices in good stead despite the recent rapid credit tightening cycle. Parts of Perth are still demonstrating median house price growth.

For the reasons set out above, rental vacancy has remained very tight, and rents have continued to increase, as migrants typically rent in the early period of residency. In fact, market rental yields are returning to levels not seen in Perth since the late 1990’s and probably unachievable in most major capital cities in Australia.

The observations above ponder many questions about the near term such as:

- What happens when this record volume of ‘Houses’ under construction is gradually delivered and building capacity improves or returns to normal?

- Will recent interest rate hikes and predicted future increases eventually tip the market into decline?

- Is future population growth enough to absorb all this new supply?

- Will WA see another year of 50,000-person population growth?

- Will low vacancy, high housing costs, and a return to more normal working arrangements shift household sizes again?

For the next 12 months at least, we expect the market to remain buoyant and in growth territory as demand will continue to outstrip supply. But in financial year 2023-24, we expect the market to become more balanced, as this supply-demand imbalance gradually improves alongside dwelling delivery.

This is predicated on the RBA’s cash rate stabilising around current levels.

At this juncture, it seems the Perth housing and unit market may remain buoyant in the short term. The Western Australian economy is expected to continue expanding over the next few years, albeit at a more modest pace, and unemployment it is not expected to increase significantly.

The market remains uncertain with the RBA’s cash rate setting however indications are that inflation is moderating. As such, the supply, availability and demand factors influencing the Perth residential market suggests a stable market with potential for upside remaining.

Moreover, Perth generally remains one of the most affordable capital cities in Australia.