- Previous

- Share

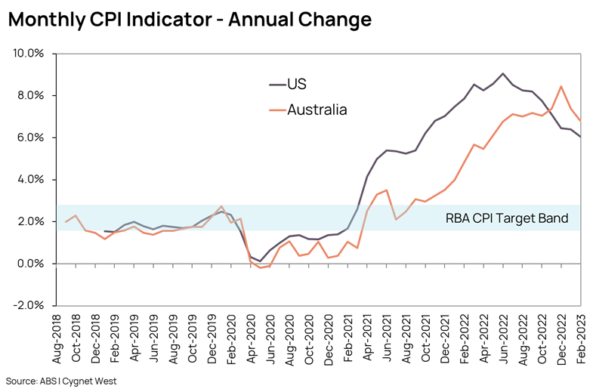

Inflation may be moderating but it remains well above target and as such a concern

Last week’s ABS monthly inflation indicator release provides some hope that the RBA’s interest rate hike has done the job and is driving a moderation in demand and consumption.

The monthly data show inflation slowed to 6.8% in February 2023 compared to prices during the corresponding month in the previous year, this is down from a peak of 8.4% in December 2022. Interest rate adjustments to control demand and prices is a blunt monetary tool, and the desired effects take time to materialise in demand and price statistics.

Given the effects of the past ten consecutive rate increases are beginning to show up in the price statistics, expectations for a pause in rate increases at the RBA’s April 2023 board meeting have grown, but with the inflation rate still well above the target band of 2.0% to 3.0%, and a more pessimistic US Federal Reserve, it is likely?

Apart from ‘Holiday travel and accommodation’ and ‘Recreation and culture’, the data broken down into the spending groups show that most prices still increased during February 2023. Is the reduction in prices for just two groups enough to stay the RBA’s hand?

The US Federal Reserve recently increased their federal funds rate again, this time by 25 basis points. This was despite there being a sustained moderation in inflation in the US from a peak of 9.06% in June 2022 to 6.04% in February 2023.

The Reserve Bank governor pointed to an eventual pause after the previous March 2023 increase saying – “We also discussed that, with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.” Notwithstanding, given the US Federal Reserve’s recent increase to the federal funds rate and whilst Australia’s inflation is still growing at a rate of 6.8% in the year to February 2023, well above the 2.0% to 3.0% target band, we consider the RBA may see the need to hammer at least one more nail into the inflation coffin before they pause to assess the situation.