- Previous

- Share

Perth average residential vacant lot sizes have been shrinking

Over the past ten years, the average size of lots in residential vacant land subdivisions have shrunk from an average of 472m² in 2012 to 432m² in 2022, a decline of 8.5%.

To break it down, the proportion of developer lots sold that are under 300m² has increased from 11.5% of sales in 2012 to 14.6% of sales in 2022. This accounts for the rising uptake of cottage blocks and townhouse/duplex type lots that have increasingly been introduced in urban fringe subdivisions to counter the rising subdivision land delivery and housing costs, and to also cater for lifestyle shifts as a new generation of homeowners enter the housing market who prefer not to choose larger, higher maintenance housing options.

Although the availability and sales of these sub 300m² lots have become more prominent in the land subdivision product mix, it’s still only a fraction compared to the dominate lot sizes of between 300m² and 600m². The dominant lot size is currently 350m² to 400m², which accounts for approximately 23.6% of developer lot sales in 2022, and this proportion has been relatively consistent for the previous three years.

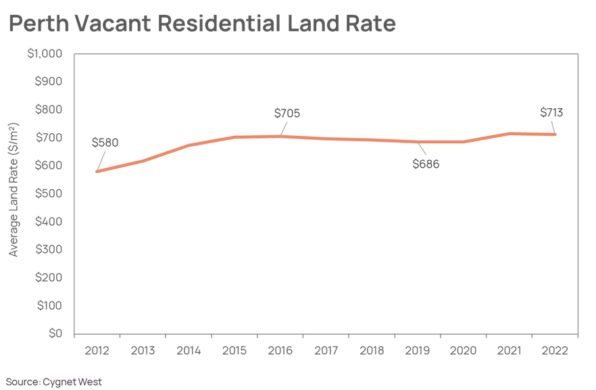

Interestingly, and despite these reduction in lot sizes, vacant residential land in Perth remains relatively good value for money. Cygnet West analysis suggests that the growth in residential land rates, especially in the urban fringes of the city have on average lagged inflation for the past 10 years.

On a compound basis, vacant land rates have grown 2.08% per annum since 2012. During the same time the ABS CPI index for Perth has been rising 2.41% per annum. According to CoreLogic median price data, Perth’s median house and unit prices remain approximately at the same level they were in 2012 before adjusting for inflation.

So, at face value, Perth land and housing prices are currently more affordable, and dare we say it, better value for money than most other capital cities in Australia. After adjusting for inflation, you get even more bang for your buck.