- Previous

- Share

Large Format Retail Space Supply Recovering

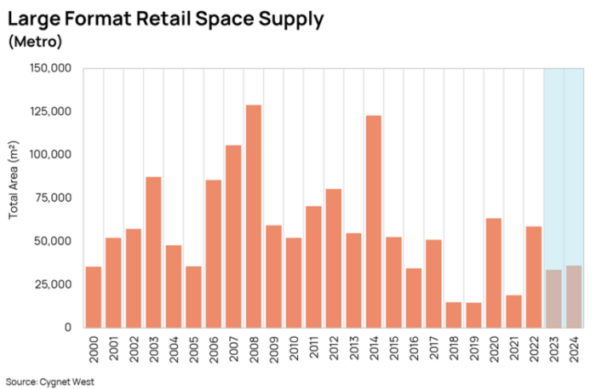

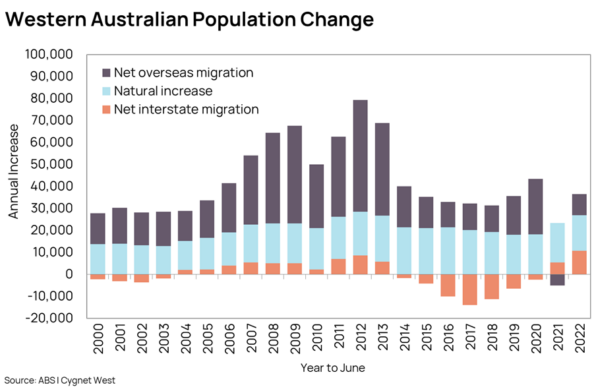

Between 2000 and 2014, supply of large format retail (LFR) space surged as Perth went through cycles of strong population growth, increased housing construction activity and the expansion of the city outwards along the metropolitan growth corridors.

Rents in shopping malls and traditional retail precincts were also increasing and becoming less economical for retailers that either needed or wanted larger floor display space. These retailers then increasingly sought larger tenancies within traditional industrial precincts and/or along major thoroughfares, which had the capacity to accommodate larger tenancies at relatively cheaper rents.

The lower cost of development and stronger yields relative to traditional retail projects led developers to responded with large standalone showrooms and large format/bulky goods centres developments, also known as homemaker centres, and supply subsequently surged.

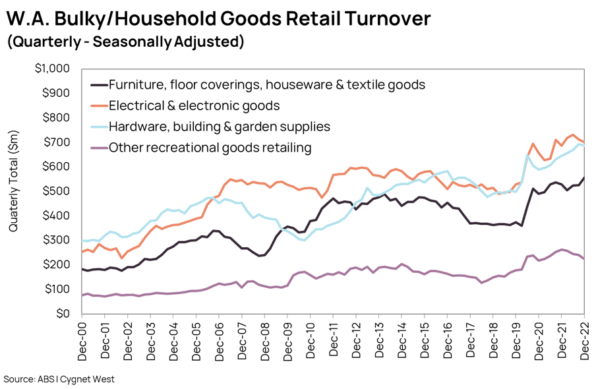

The downturn in population growth following the resource investment boom of 2006-2014 saw dwelling construction slow, resulting in demand for these spaces to moderate. Supply of new LFR space subsequently moderated after 2014. However, recovery in population growth beginning 2018/19 saw demand gradually recovery. The outbreak of COVID-19 further amplified demand as retailers benefited from government subsidies, tax, and cash stimuli. The pandemic accelerated the changes that had been taking place in retailing channels, and the shift to remote working saw an increase in home-office setups and home renovations. Turnover in the bulky goods segment subsequently rebounded and demand for LFR space once again improved.

The performance and resilience of this asset type through the pandemic together with a rosy outlook for expenditure in the bulky goods segment led to an increase in the weight of capital chasing these assets, which has resulted in large format store supply recovering in the past three years. Last year, 2022, saw almost 60,000m² of space delivered.

Cygnet West’s current forward supply projection suggests around 33,500m² of large format space may be delivered in 2023, and this could be followed by a similar volume in 2024.

The 2024 projection is likely to be revised upwards and the volume of supply for 2025 could be somewhat stronger, if dwelling construction improves alongside faster population growth, and the State’s economy maintains a modest growth trajectory. However, rising interest rates is expected to deliver some moderating pressure on bulky goods turnover growth.