- Previous

- Share

Impact of interest rate hikes

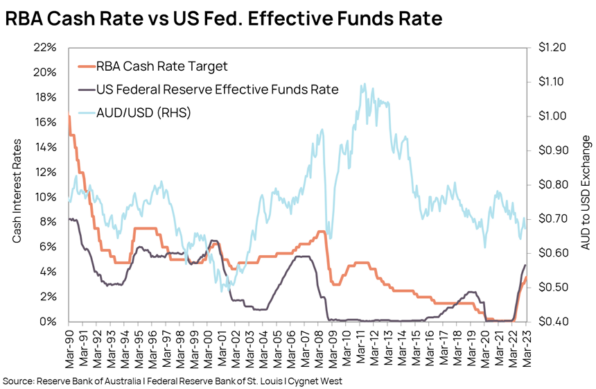

As was widely anticipated, on 7th March, the Reserve Bank of Australia increased the Cash Rate for the tenth time within the past year. Now at 3.60% it is the highest level since May 2012, but it remains lower than the US equivalent Effective Funds Rate.

Historically, the RBA’s Cash Rate has been set higher than the US Federal Reserve’s rate, except on a limited number of occasions in the past three decades where the US Fed has positioned it rates to be higher than the RBA’s rate. There are some other factors that also influence the cash rate decisions, such as capital flows and exchanges rates. However, as evident historically, we can expect the RBA Cash Rate to revert to being higher than the US Fed Reserve’s rate in the year/s ahead, either due to the US Fed reducing their rates or the RBA increasing its rate further.

How have rates impacted the Perth residential property market?

We were previously of the view (in 2022) that Perth’s residential market could withstand higher interest rates, i.e., absorb the higher rates with limited negative impact on market pricing. For the most part this has held true. Given Perth’s relative affordability, limited ‘for sale’ stock, higher material cost, constrained building sector capacity, historically low dwelling completions, low rental vacancy rate, rapidly rising rents, robust economic activity, a recovering migration intake and past wages growth, house prices have held relatively steady; and in some locations, have continued to increase modestly over the past few quarters despite the consecutive cash and subsequently mortgage rate increases.

According to CoreLogic RP data’s Daily Home Value Index, as of 8th March 2023, Perth’s home value index has only retraced by 1.01% since the August 2022 peak. This is, by a considerable margin, the best performing market of the 5 major capital cities.

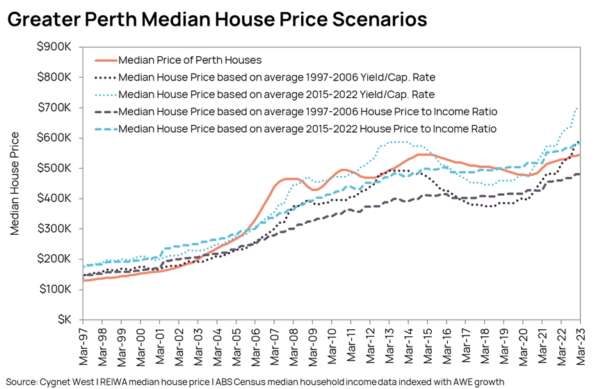

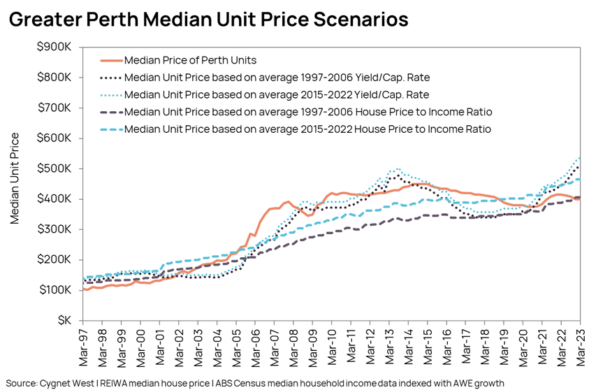

The recent March 2023 rate increase prompted us to revisit some of our analysis and assess the extent it could have on housing affordability, demand, and the potential impacts of future increases. The comparisons include gross market rental yields and house price to income ratio. We also looked at how much it costs an average household to service a home loan at current settings.

The outcome of our analysis indicates the prevailing median ‘House’ and ‘Unit’ prices, as reported by REIWA, can still be supported at the current estimated Perth median household income and market rental yields – if we compare and apply historical average metrics/multiples.

Interestingly, three of the four scenarios we tested suggests notably higher medians could still be supported. However, we have seen prices generally stagnate as other factors, such as market sentiment, the rising cost of other living expenses and/or stricter lending assessments may be suppressing the median from rising to its full potential based on the historical multiples.

While Perth prices were generally stable in the past six months, we have seen other capital city median prices fall notably. Unfortunately, we do not currently have access to up-to-date data on other cities to compare, but we hypothesise that this was largely due to the multiples of other cities being considerable higher than historical averages prior to the commencement of the RBA’s tightening cycle.

Perth was fortunate in that after several years of weak market conditions, it’s multiple had reverted to or below historical metrics. What this indicates to us is that in the short term, Perth residential price stability may persist, as they have shown to since interest rates began to rise, despite the higher servicing costs and general reduction in borrowing capacity and predictions of price contraction from various sources. This is because most of the historical multiples suggest Perth prices are still generally affordable and/or potentially underpriced.

If interest rates remain stable, migration continues to grow, unemployment does not rise significantly, and listing stock remains low – there is potential for a modest/gradual uptrend in Perth’s median prices in 2023. However, we will take a conservative approach and suggest prices will probably remain stable, given that there will be pockets of weakness, and strength, within the broader Perth market.

Our assessment of first homebuyer servicing ratios, that is the amount of household income required to service a median price mortgage, also suggests that current pricing is supported. However, it does trigger some warnings and paints a more subdued outlook.

At current levels of estimated Perth median household income, variable mortgage rates, and median ‘House’ price, mortgage serving costs, for a principal and interest loan would swallow just over 53% of a first homebuyer’s median household income. Although there have been periods in Perth’s history where this ratio has been higher, it was only temporary and subsequently reverted to around or below the long-term average of 50%.

The reason this ratio paints a rather subdued outlook for the Perth market is because loan servicing requirements for recent and future first home buyers with limited equity, when combined with other living costs that have also escalated rapidly, has become a major challenge. Any additional Cash Rate increase will likely have an amplified effect on their ability to service the higher mortgage repayments. This could lead to some moderation in dwelling prices, as demand from this buyer group subsides further, which could temporarily create a larger imbalance in the supply-demand equation, especially when recent buyers become forced sellers as rates increase further.