- Previous

- Share

Vacancy rate edges lower and occupancy reaches new high

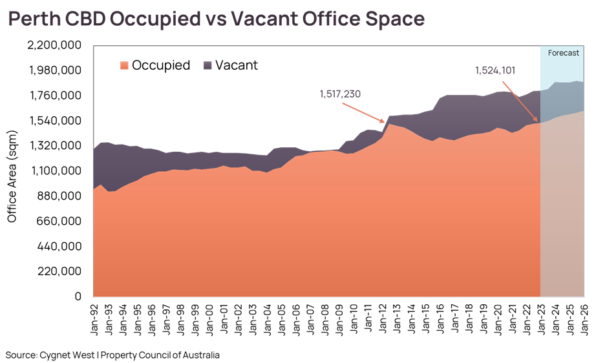

Perth’s CBD office vacancy has continued its downward trend, with occupancy reaching a new high as Western Australia leads the nation in returning to traditional working arrangements.

The Property Council of Australia’s latest data placed the Perth CBD office vacancy rate at 15.6%, down from 15.8 per cent in July last year. Over the six months to the end of January 2023 the market absorbed another 6,086sqm of vacant space, the PCA’s Office Market Report showed.

And as we had anticipated, Perth CBD’s occupancy reached a new high of 1,524,101sqm at the end of January.

Despite predictions of potential armageddon for office markets due to COVID-19 and remote working, WA’s strengthening economy and the realisation of the necessity for commercial office space, has helped the Perth CBD market absorb 42,724sqm of space in the two years since January 2020.

This take-up drove a decline in the CBD office vacancy rate from 17.5% in January 2020 to the 15.6% recorded in 2023.

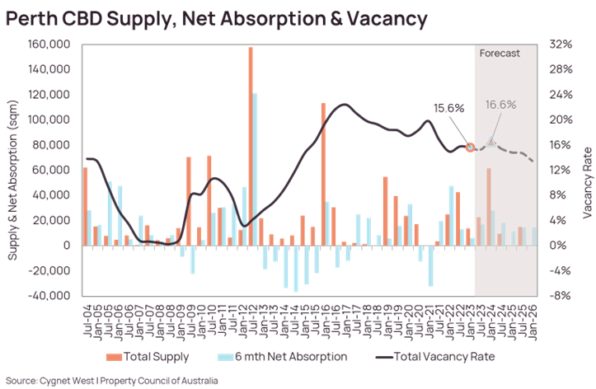

In the past year, Perth CBD stock has increased by 35,996sqm, largely a result of refurbished space coming back into the market.

Over the next 12 months, three new office developments are forecast to deliver approximately 73,500sqm to market, the largest being Chevron’s headquarters at Elizabeth Quay. The other two, Capital Square Tower 3 and Westralia Square 2, are also scheduled to be completed during the year.

Cygnet West Director of Research Quyen Quach said the significant delivery of space over the next year is anticipated to drive the vacancy rate temporarily higher by the end of 2023.

Mr Quach said Cygnet West currently estimates it may increase to 16.6%, but further absorption in 2024 and beyond is expected to result in a return to declining vacancy if no major new supply is added over the next three years.

“Despite the slight increase in vacancy, we anticipate the Perth CBD market to absorb circa 45,000sqm in the next year, based on white collar employment growth projections and our reading of the potential office space demand,” Mr Quach said.

“This, we expect, could lead to office occupancy increasing even further from its current record level.”

Mr Quach said the expected increase in vacancy during 2023 may act to dampen rental growth.

But at the same time, he said strong demand and competition for plug and play options in refurbished or new space from companies expanding off the back of strengthening population growth and improving economic activity could result in face rents for this type of space continue to increase.

Cygnet West Partner in Commercial Leasing Dustin May said “We have seen incentives trend lower more recently, however, continuing competition for tenants in a market with more than 15% vacancy could reasonably be expected to keep average incentives in the 40’s percentage range over the next 12 months”.

“The trajectory of construction costs could play a key role in determining the fate of market rents.”

“Landlords have been factoring in higher building and fit-out delivery costs into asking rents in the past year, and this may continue if cost inflation persists.”