- Previous

- Share

Occupancy hits record high but vacancy rate up in Perth CBD

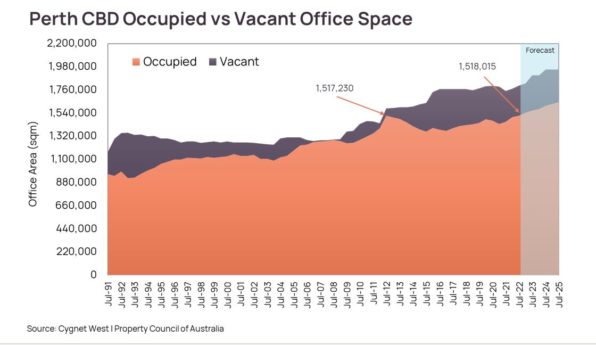

Occupancy of office space in the Perth CBD has hit a new record high, surpassing levels seen during the resources boom – but the addition of new and refurbished space has pushed the official vacancy rate higher to 15.8 per cent.

The latest Property Council of Australia (PCA) Office Market Report revealed vacancy in the Perth CBD had climbed by 0.8 per cent to 15.8 per cent in the six months to July 2022, thanks to the addition of some 42,826sqm of refurbished and new supply. At the same time, demand for office space in the city has delivered a significant boost to occupancy levels, pushing that figure past a decade-old high.

Cygnet West Director of Research Quyen Quach said the jump in occupancy levels was in line with the agency’s forecasts.

“Despite the higher vacancy, our expectation that the CBD will set new highs in office occupancy this year has started to materialise, with the PCA reporting 1,518,015sqm of space being occupied in July 2022,” he said. “This is slightly higher than the previous record set exactly 10 years earlier in 2012 when, at the height of the resources sector investment boom, 1,517,230sqm was occupied. This latest figure indicates 13,302sqm of office space was soaked up in the six months to July 2022.”

Perth’s CBD currently has significantly more stock than it did in July 2012, with approximately 237,780sqm of newly built space added over the past decade. Coinciding with the moderating resources sector activity, this new supply has been one of the major challenges for rental growth since 2012.

While the risk perception of COVID-19 has eased, the CBD’s daytime working population remains below its current potential with a number of employees continuing to opt for work from home or remotely during the week. Despite this, pedestrian traffic in the CBD is gradually increasing – which has been good for CBD retailers.

“The PCA occupancy data is aligned with our view that the negative pandemic impacts and associated shifts to flexible working arrangements are going to be significantly less than what some had or are still predicting for the Perth CBD office market,” said Mr Quach.

“There may be some fluctuations, but we expect further record-breaking CBD office occupancy levels in the years ahead, given Western Australia’s status in the global commodity supply chain will likely increase in importance and the population will continue to grow on the back of more employment opportunities.”

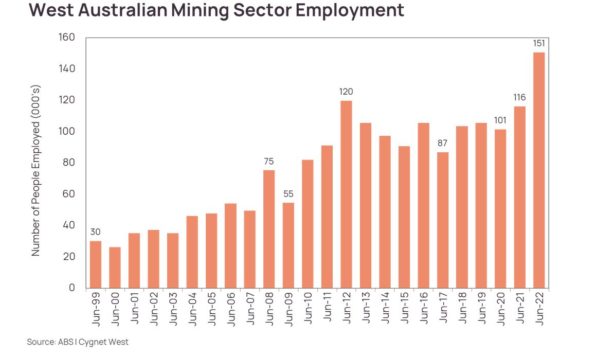

The WA resources sector is roaring back and employment within the mining sector has also established a new high, with Australian Bureau of Statistics data showing it had reached 150,666 employees as of June 2022, which is 25.7% higher than the 2012 peak of 119,821.

The increase in mining sector activity and employment has rippled through to associated administrative and supplier employment, generating an uplift in both office space demand and market face rents in recently refurbished buildings and well-positioned assets with low vacancy profiles. However, competition for tenants continue to be high, keeping incentives between 40 per cent and 50 per cent for prime grade assets during the June 2022 quarter.

Cygnet West Partner of Commercial Leasing Daniel Taylor said there had been a clear shift in sentiment around increasing footprints for office tenants.

“On the ground, and based on our daily interactions, there is appetite for expansion from a majority of tenants enquiring on available space,” he said.

“However, they are currently hamstrung by staff shortages and a restricted labour pool to attract staff. And it isn’t just the mining sector, we are hearing it across the industry spectrum.”

Looking ahead, Cygnet West sees a more positive outlook for rental growth. Rising commercial project funding costs, building capacity constraints and higher returns hurdles from developers will likely lead to higher pre-commitment asking rents. This provides scope for increased asking rents in established buildings, as new supply will take longer than normal to materialise.

A rising CBD occupancy will likely trigger the commencement of new supply projects and more major refurbishments over the next five years, particularly when labour and construction cost issues begin to ease, or higher market rents boost project feasibility.

Multiple development sites are actively working to secure precommitments from major tenants seeking an opportunity for a fresh office to accommodate the changing work environment, or upgraded accommodation to attract and retain staff in a tight and highly competitive labour market.

“Taking into account existing economic and employment growth expectations, potential new supply and changing office space requirements, we have revised our vacancy rate forecast for the CBD to 16.9 per cent in 2023, when One The Esplanade is competed and Chevron migrates to its new headquarters,” said Mr Quach.

“Notwithstanding that higher vacancy rate, we expect to see CBD occupancy increase to around 1,578,715sqm by the end of 2023 – and that’s an additional 60,700sqm of net absorption over the next 18 months.”