- Previous

- Share

Cygnet West sees new high in CBD office occupancy in 2022

As the scale and seriousness of COVID-19 became clear to Australians in 2020, and cities locked down and emptied out, property market concerns quickly came to focus on the potential impacts on future demand for office space.

Forecasts at the time, particularly those focused on Sydney and Melbourne, were grim, but the Cygnet West team was confident any negative impact on the Perth CBD office market would be transient.

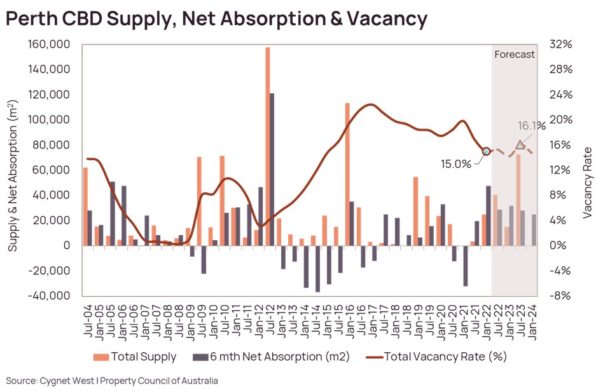

The latest office market figures from the Property Council of Australia confirm that confidence was well-founded, with the official vacancy rate for the Perth CBD contracting two per cent to 15 per cent – its lowest level in seven years.

“Prior to the pandemic we had seen a recovery underway in the Perth market, and we believed that trend would resume as we came out the other side. That has been borne out by the latest Office Market Report figures,” said Dustin May, Partner – Commercial Office Leasing.

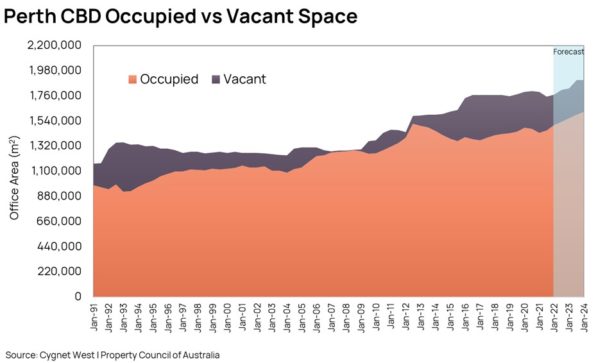

“Over the past 12 months the CBD and West Perth office markets have absorbed 83,053sqm of space, which is the strongest level of net absorption since 2012. Total occupied office space in the CBD is now higher than pre-pandemic levels, and approaching the peak of 1,517,230sqm recorded in July 2012.”

Cygnet West research forecasts predict the total volume of active office space in the Perth CBD will increase to approximately 1,827,500sqm by the end of 2022, up from the current reported volume of 1,771,835sqm.

And still more office space is set to be soaked up over the course of the year.

“Our current modelling projection suggests that the Perth CBD will actually witness a higher level of occupancy during the second half of 2022 than that recorded at the 2012 peak,” said Quyen Quach, Associate Director – Research.

While early forecasts had tipped shrinking demand for office space, Partner – Commercial Leasing Daniel Taylor said a shift towards more open premises and collaborative approaches to working meant in fact many occupants were looking for a bigger footprint.

“We expect that forecast increase in occupancy will likely be driven by several factors,” he said.

“They include stronger resource sector activity in WA, a recovery in population growth, a flight to quality and a growing appetite for bigger areas of break-out and collaborative space.”

Cygnet West Partner and Head of Commercial Agency Wayne Lawrence said the resurgence in confidence in the Perth CBD wasn’t limited to the office leasing market, with investor interest also on the rise.

“We were confident from the start that the Perth market would rebound from this black swan event, and evidence since indicates we were on the money,” he said.

“Investors are seeing the dual benefits of a recovery in office space demand and the large yield spread between Perth and most major alternative investment markets.

“Rising global inflationary pressures and the subsequent yield reversion threat has, in our view, increased the attractiveness of Perth’s assets which exhibit significant yield spread as compared to Eastern states markets.”

However, Mr Quach said the predicted uptick in occupancy didn’t mean 2022 would be without its challenges – and this was particularly true for the secondary market.

“Absorption of new and returned refurbished stock will likely mean the vacancy rate recovery for the Perth office market will lag,” he said.

“The flight to quality could mean more capital expenditure is necessary, and could see more tired stock being withdrawn for refurbishment.

“We currently envisage the vacancy rate in the CBD could increase slightly to 16.1 per cent when One The Esplanade is competed and Chevron migrates to its new headquarters in 2023.”