- Previous

- Share

The ABS Census is such a critical component in understanding what we have and what we need

Here at Cygnet West, we love our data, and we especially love the ABS Census Data. With a set of 64 well-targeted questions, the Census can shine a light on so many issues.

Not many people have the opportunity to delve deeply into the data like researchers do, most will read or hear a headline figure like: “… the population grew 1.1%…” and shrug. But sometimes when reviewing the data, something pops out at you, and when @Quyen Quach, Cygnet West, Director Valuation, Research and Advisory was reviewing a population growth chart recently something did pop out – the updated population growth trajectory looked notably steeper than what he had previously remembered.

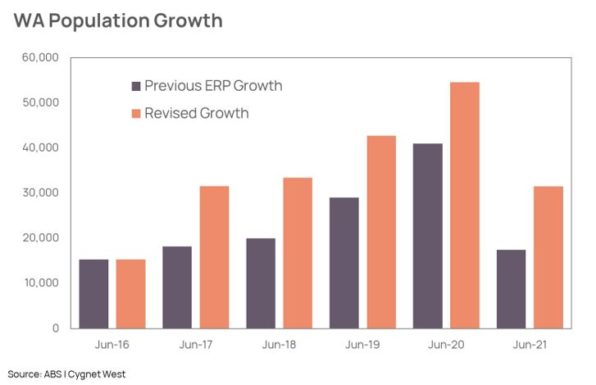

The ABS updates Estimated Residential Population or ‘ERP’ on a quarterly basis, there is usually a six-month lag and it gets refined/revised every five years using the Census. The most recent refinement, using the 2021 Census, revealed that WA’s population grew notably faster than had been previously estimated in the ERP.

How much was the old ERP out by? Well as of June 2021, there was a total of 68,230 more residents in WA than previously estimated.

Ordinarily, if you put 68,230 people next to a population of circa 2.7 million it wouldn’t seem noteworthy, as it would mean a differential of only 2.5%. But if you are forecasting housing requirement and you assume the average household size is 2.5 persons per household (which is the WA average) you will be short 27,280 dwellings. Given WA has historically built around 20,000 dwelling per annum prior to the pandemic, that shortage would be equivalent to almost 1.5 years of supply: that’s a lot of dwellings by anyone’s standard.

It’s any wonder the availability of both rental and for sale housing stock on the market is currently so low; and capital values and rents had risen so sharply. This now appears like the perfect storm when you add in the fact that during the same period the population was being under-estimated, WA had been delivering new dwellings at record low volumes of circa 13,500 per annum in last two years to March 2022. Not since the late 1990’s have we seen this level of low supply.

Now there is a mandate to cut red tape and encourage more skilled migration, to try and alleviate the skills shortage plaguing the economy. The skills that need prioritizing in the short term should be in the building and construction industry, to get dwelling completions back to longer term averages so that new migrants are able to get access to appropriate and affordable housing. Otherwise, it is likely housing prices and rents will continue to increase, and exacerbate the current rental stress being experienced in the rental market.

It may even become difficult to attract skilled migrants if they are unable to source appropriate housing options.

If you would like more an in-depth analysis of the data or more information on WA’s property market, give the Cygnet West team a call. We have been working in the Perth market for decades and have the accumulated, deep market intelligence to help you understand and weather the economic cycles.

We live here, We work here, We invest here – We Know Here! We are Cygnet West.

For more information contact:

John Del Dosso

Head of Valuation, Research and Advisory

[email protected]

Queyn Quach

Director | Valuation, Research and Advisory

[email protected]

Enzo Evangelista

Director | Valuation, Research and Advisory

[email protected]