- Previous

- Share

WA Housing Cycle

Compare the pair – 2009 mining boom vs 2023 construction boom.

This isn’t the first time we’ve experienced a challenging housing cycle. In 2009 towards the end of the mining boom, Perth’s housing economy followed a similar pattern to what we’re encountering now.

The cycle moderated when the exploration and construction cycle started to slow down, winding up many new jobs that had encouraged migration to Perth. As the less-labour intensive production cycle began, migration to Perth tapered off.

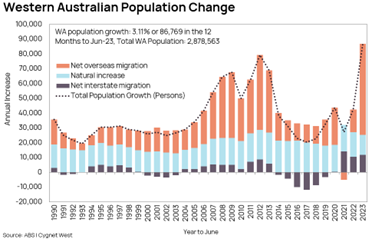

The vast difference between then and now is the significant increase in total population, as well as the rate of increase. From 2005 to 2008 total population growth was 205,693 persons. From 2020 to 2023 total population growth was 214,976 persons.

Most notably however, over 2007 and 2008 combined, the state grew by only 124,944 persons – equivalent to 60% of population growth for the four-year period. Whereas over 2022 and 2023 combined the state grew by 152,708 persons, this is equivalent to 71% of the population growth over the four-year period.

The current housing crisis is a consequence not only of the change in population, but the speed at which it is changing. Due to our population growth rate and supply chain difficulties being brought on by COVID, Cygnet West researchers speculate it could take longer for the vacancy rate to increase. The current vacancy rate has remained between 0.6% and 0.7% in the last year.

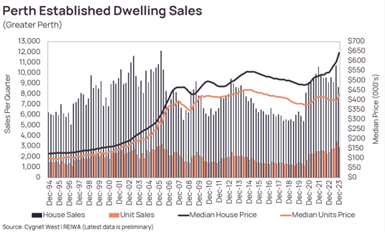

During this time, CoreLogic reported that the Perth median established ‘house’ value rose 13.8% over 2023, to $676,910 in December. At the same time, Perth median ‘unit’ values have risen 10.9% to $457,296.

If the vacancy rate and median house prices remain the same, we can expect to see a continued upward trend in WA Total Alterations & Additions Commencements (extensions and/or renovations). In December 2023 alone, $250million was spent on home improvement, the second highest figure in over 20 years.

It is expected that median dwelling prices will continue to rise, while interest rates and construction costs continue to adversely impact supply. If you’re waiting for ‘the market to crash’, you may be waiting a little while longer.

For real estate and housing market updates from Cygnet West’s dedicated valuations and research team, subscribe to our quarterly newsletters.