- Previous

- Share

Insight into the RBA cash rate increase

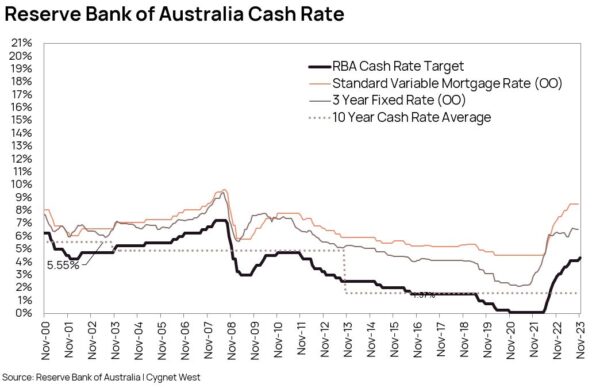

On Tuesday 7 November the RBA announced it was raising the cash rate to 4.35%1.

The 0.25% increase will impact people and organisations differently, but what exactly is the Reserve Bank of Australia trying to achieve?

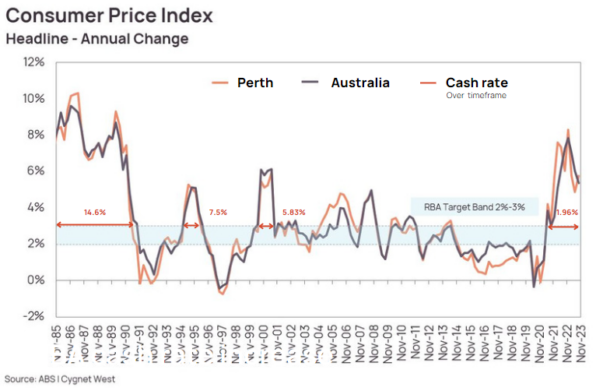

We’ve been here before – the last 2 times the annual change in CPI sat above the RBA target band of 2%-3% was in the early 2000’s and in 2007 during the mining boom.

As a measure to control inflation the RBA had the cash rate target at 6% in the early 2000’s and at 6.75% during the mining boom. The annual change in CPI was at 6% and 5.5% respectively at these times.

The latest data shows the annual change in CPI2 currently sits at 5.37% which is way above the RBA target band. Last time it was this high the cash rate increased to 6.75%.

As of today, the cash rate is 4.35%, which is 2.4% lower than the last time we had the same annual change in CPI.

Previously when the annual change in CPI has sat above the RBA target band for more than 12 months, there has been a higher interest rate. The average interest rate for each of these time periods was 14.69% (1985 – 1991), 7.5% (1994 – 1996), 5.83% (2000 – 2001).

The annual change in CPI has been above the RBA target band since 2021 and over this time-period the average cash rate for the period has been only 1.96%. History suggests this average needs to rise for the interest rate to have its desired effect on inflation.

If the RBA continues to increase the cash rate in increments of 0.25 percent, we can expect several more rate increases before inflation is moderated.

Where are we headed and when will it end?

Justin Caldwell, Manager | Valuation, Research & Advisory

Graph 1.

Graph 2.