- Previous

- Share

Ageing workforce creating concerns in construction

Skills shortages in the construction sector of Western Australia are likely to escalate as an ageing workforce transition into retirement, placing additional pressure on an already strained industry. Industry leaders have identified labour shortages as the biggest challenge facing the construction sector in 2023, even as activity starts to cool from stimulus-driven record highs experienced throughout the pandemic. As many workers move closer to retirement over the next five to ten years, those shortages could be exacerbated, according to Quyen Quach, Head of Research at Cygnet West.

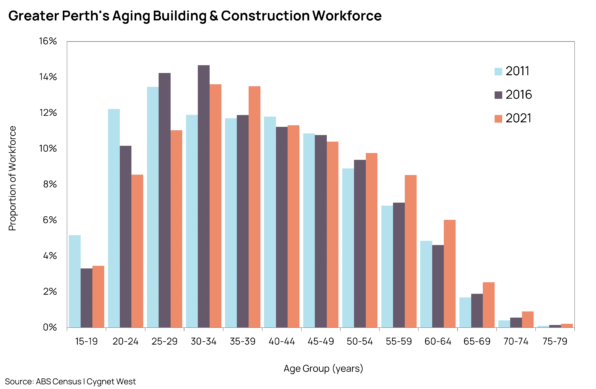

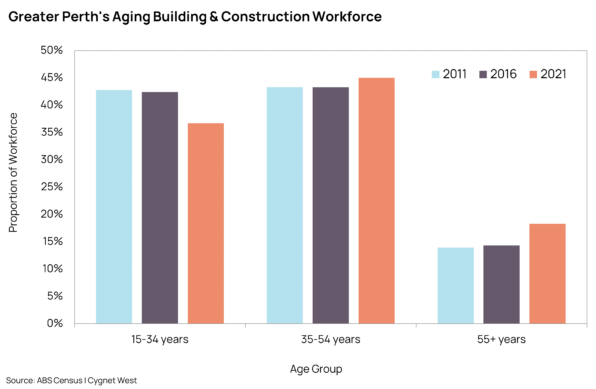

Mr Quach stated that data from the Australian Bureau of Statistics’ 2021 Census indicated that the Perth construction sector could soon be facing its largest industry exodus on record. “The 2021 ABS Census showed the proportion of the sector’s workforce aged over 35 years has grown, while the proportion of those under 35 years has fallen in the past 10 years in Perth,” Mr Quach said. “The growth in those over 55 years is significant, with the industry possibly set to lose more than 18 per cent of its most skilled and experienced workers over the next five years as those workers progress towards retirement.”

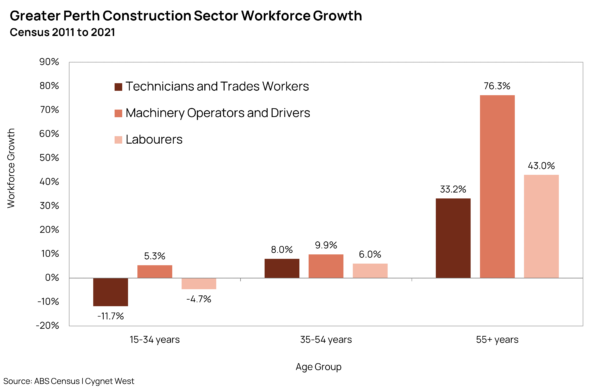

Mr Quach said the Census data showed the total number of technicians and trades in the Perth construction industry aged under 35 fell by 11.7 per cent between 2011 and 2021. “At the same time, the number of workers aged over 55 years increased by more than a third,” Mr Quach said. “The data is similar for labourers – the Census showed the number of labourers aged under 35 years fell 4.7 per cent over the same time, while the number of workers aged more than 55 years increased by 43 per cent. The difference in growth in machinery operators and drivers may also be of concern, with those aged over 55 years increasing 76.3 per cent and those under 35 years have only increased 5.3 per cent during the same period.”

Mr Quach said new initiatives are desperately needed to attract trainees and apprentices to the sector to keep up with increasing demands for skilled construction labour. “The Master Builders Association estimates that nearly 55,000 new workers will be needed in WA by 2026 to keep pace with demand and offset the impacts of those exiting the workforce,” Mr Quach said. “However, it’s not entirely clear if the sector can attract and train that many workers, raising real concerns for the future of construction in Australia. If this is the case, and we are unable to expand the workforce that rapidly, the competitive environment could mean the cost of building will remain high, which won’t help inflation or housing affordability.”

Mr Quach said a concerted effort is required to grow and diversify the construction sector workforce organically, through education and training as well as through migration programs. “The establishment of Australian-funded and accredited training centres and programs situated at facilities in countries neighbouring Australia, such as Timor-Leste, Papua New Guinea, Solomon Islands, and other Pacific Islands nations could help grow the pool of skilled labour force amongst our neighbours, providing close access labour when we need them and also further strengthening diplomatic ties,” he said. “In the long term, these skills would also assist our neighbours to modernise or improve their construction sector, boost living standards and help generate more social and economic stability.”

Additional government funding is also required to boost research and development in building industry technology, Mr Quach said. “Robotic technology such as those being developed by FBR or Luyten are great examples where technology will help boost productivity significantly, but needs to be rolled out faster,” he said. “Funding to help push prefabrication technologies or alternative building methods would also assist future productivity growth and improve the supply elasticity issues that traditionally plague this sector.